The European Union, and Italy with it, is bent on reducing its dependence on Russian natural gas by turning to other suppliers, and efforts are starting to pay off.

The United States has been crucial in this regard. In December, the Biden administration began shipping cargoes of liquefied natural gas (LNG) by sea, and in the past weeks it has pressured allies and partners to increase gas deliveries to the Old Continent.

Euractiv reports that European countries imported more than 11 billion cubic metres (bcm) of LNG in January. Almost half of it came from the US; Australia, Azerbaijan, Egypt, Japan, Nigeria, Qatar and South Korea have also agreed to increase supplies.

The levels of European gas reserves are now nearing normal volumes. On Tuesday, the President of the Commission, Ursula von der Leyen, announced that European models “now show that we are quite safe in case of a partial interruption or a further decrease of gas deliveries by Gazprom.”

The additional cargoes have calmed the gas markets, which have been on edge for months due to reduced Russian supplies and the Ukrainian crisis. Today, the price of gas on the European market (based on the Dutch TTF index) is just above €70, down from a €180 peak near Christmas.

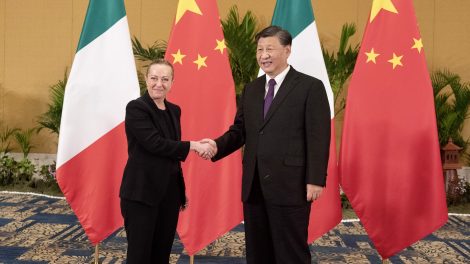

The Italy-Qatar agreement

In the meantime, Mario Draghi’s Italy has been conducting a parallel operation, again with the aim of reducing dependence on Russian gas, which makes up 40% of total gas imports. On Monday, flanked by Foreign Minister Luigi Di Maio, the Italian PM received Qatari Deputy Prime Minister and Foreign Minister Mohammed bin Abdulrahman al Thani in Rome

That was the first round of the strategic dialogue between Italy and Qatar, announced on December 20 through a Memorandum of Understanding.

At the presser that followed the meeting, Mr Al Thani emphasised the two nations’ “strong strategic relations” and their “common positions on international issues that aim to achieve global peace and security.” Mr Di Maio described Qatar as “a strategic and reliable energy partner for Europe and Italy” and spoke of a “common desire to enhance cooperation” in the energy sector as well.

Doha currently supplies about 10% of Italy’s imported natural gas. Rome, on its part, possesses extensive storage facilities, and – thanks to its international pipeline network – Italy can count on a more diversified and stable supply than northern European countries, so much so that in recent months it has even managed to export part of its supplies.

Ramping up national production

Natural gas accounts for 42% of Italy’s energy mix, and is slated to remain an essential driver of the energy transition. However, the country only produces a fraction of what it consumes – 5% of it, roughly 3.5 bcm a year. In the past decade, political opposition to new drillings and expansion of existing production facilities suffocated the gas industry’s internal operations.

The ongoing energy crunch, along with the evolving discussion around the energy transition, has managed to soften some of the most extreme environmentalist opposition to natural gas. Also, Mr Draghi’s government tends to take a more pragmatic approach to these issues.

Ecological Transition Minister Roberto Cingolani and Economic Development Minister Giancarlo Giorgetti, have called for returning to exploiting Italian methane fields instead of increasing imports. The matter is now up to the State-Regions conference, who are expected to deliver a foundational document in the short term.

Analysts estimate that the Italian underground houses roughly 92 bcm. A political go-ahead and a relatively low investment on behalf of petrol companies would be enough to double the current gas production. The resulting 7-8 bcm a year would amount to roughly 10% of Italy’s yearly consumption.